The Treasury is consulting on ‘VAT and the Sharing Economy’. This is prompted by concerns for a level playing field between traditional businesses and newer models made possible by the internet, and also about loss of tax revenue.

The innovative approach of Uber, and to a lesser extent other providers using digital platforms, has made a significant improvement to the quality of transport services. The market for taxis is competitive, involving black cabs driven by owner-drivers as well as ‘minicabs’ whose owner-drivers taking bookings via a local agent. There is no evidence of tendency to monopoly by the dominant digital platform. In general, no taxis charge VAT so that providers of taxi services via digital platforms have no competitive advantage.

Accordingly, charging VAT on taxi fares collected via a digital platform would distort competition, at least while the VAT threshold applies to owner-drivers. There may be a case for abolishing the threshold for all taxi services to achieve a level playing field, although this would be onerous for those drivers who work part time to supplement earnings from their main employment.

If the VAT threshold were retained for owner-drivers other than those operating through digital platforms, the platforms might seek to preserve their competitive position by absorbing the tax through taking more commission from the drivers, although that would be limited by the need to pay enough to recruit drivers. In this situation, drivers offering taxi services via digital platforms would be disadvantaged. Alternatively, were VAT not to be absorbed by the platforms, fares would be higher to the detriment of consumers, leading to the platforms likely exiting the market, again to the detriment of consumers.

More generally, public transport fares are zero rated for VAT, so levying VAT on taxis would distort the market for non-private travel.

In short, were VAT to be levied only on fares charged by taxi services provided via digital platforms, the existence of the VAT threshold would distort competition, to the detriment of consumers.

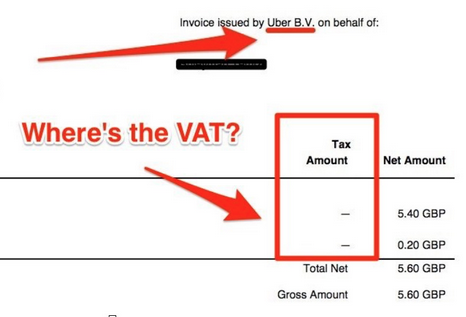

There are suggestions, unconfirmed, that HMRC has already raised a £1.5 billion VAT assessment on Uber.

Note added 22 February 2021: The recent judgement of the Supreme Court that Uber drivers must be treated as workers, not as self-employed, may increase the likelihood that Uber would be obliged to charge VAT on fares.