The coronavirus pandemic caused major dislocation in society, not least to the amount and modes of travel, with many similarities across countries, albeit differing in detail depending on local constraints imposed on work and travel. This amounted to a ‘natural experiment’ in that an exogenous event led to large changes in travel behaviour over a two-year period, 2020-2021, before the cause faded away and normal life largely resumed, yet with some possible permanent long-term consequences. The findings of the National Travel Survey for 2022 are ambiguous as to whether we are on the path to pre-pandemic normality, or whether some permanent changes have arisen. Transport for London has recently published its annual Travel in London report for 2023 that includes relevant data for the capital. So it is worth considering the evidence for pointers to the future.

The pandemic led to two main changes in how we live and in the related demand for travel: more working from home and more shopping online.

Working from home

While some of those who do not need face-to-face contact with customers, clients or colleagues have always worked from home, the pandemic resulted in a step-change in the numbers adopting this practice. In some cases, this was a sub-optimal response to an emergency, for instance in the education sector. In other cases, this reflected advantages of not travelling to a workplace for at least part of the week, avoiding both the time and discomfort of commuting, flexibility of when to work, and perhaps benefiting from the avoidance of interruptions in the privacy of the home environment.

For some organisations, it has been found that the workplace office could be dispensed with entirely. For many others, some form of hybrid working has emerged, with employees spending part of the week in the office, although the long-term stability of this outcome is yet to be seen. The extent of hybrid working reflects a balance between the preference of many employees for working at home and the preference of many of their managers for having people in the office – for oversight, to stimulate creative interactions and to induct new staff into the culture and practices of the organisation. This balance is affected by the state of the employment market – the demand and supply of employees with appropriate skills. The market was tight following the pandemic, with low levels of unemployment as many older workers decided not to return. But over time, this balance could shift, particularly if the benefits of agglomeration are as significant as had previously been supposed, so that businesses that have more staff on site prove to be more successful and profitable. On the other hand, businesses that commit to hybrid working may be able to attract staff from a wider area, as well as reducing the expense of maintaining office space for the full complement of staff.

Surveys by the Office for National Statistics of working adults in Britain found that while 50% reported working from home at some point in the previous seven days in the first half of 2020, early in the pandemic, this had fallen to 40% in early 2023; throughout 2022, when the restrictions of the pandemic had been lifted, the percentage of working adults reporting having worked from home varied between 25% and 40%, without a clear upward or downward trend, indicating that homeworking was resilient to the end of travel restrictions. Professionals and those in higher income bands were more likely to work from home, whereas those who require face to face contact with clients or personal engagement with facilities resumed travelling to their workplace – in education, healthcare, hospitality, retail, manufacturing and laboratories.

The emergence of a new normal involving both fully remote and hybrid working raises a question about the value of agglomeration benefits from learning, sharing, and matching in city centres. Estimation of the economic value of agglomeration has been based on econometric analysis addressing the change in productivity in relation to the change in effective economic density, with the biggest benefits accruing to knowledge-focussed businesses, despite remote or hybrid working being most feasible for such businesses. The observed movement of businesses to central locations in recent decades reflects net agglomeration benefits, the positive benefits being offset by the negative, the balance being affected by technological developments. But this may be changing.

Fleet Street, for instance, was once the physical location of the national newspapers in central London, with printing presses in the basements, print workers on floors above and editorial staff on the upper floors. This was a classic cluster, with benefits from shared facilities and staff, allowing news to travel faster and gossip to flourish. But there were offsetting disbenefits: newsprint had to be brought into central London, from where newspapers were distributed across the country overnight, and there were restrictive labour practices reflecting trade union power when the product had to be made anew each day. But then the advent of digital typesetting allowed newspapers to be printed at remote printworks with better access to transport networks, so that the editorial offices could disperse to scattered locations around London. Nowadays, ‘Fleet Steet’ is a metaphor for the newspaper industry, no longer the actual location. With hindsight, the agglomeration benefits and disbenefits were more finely balanced than had been supposed, so that new technology could tilt the balance in favour of dispersion of the cluster.

A question, then, is whether something similar may be happening more generally to knowledge-based businesses that had been benefiting from clustering in city centres. It has long been suggested that modern information and telecommunications would lead to the ‘death of distance’, yet the benefits of agglomeration seemed to trump those associated with dispersal. But then the shock of the pandemic both enforced working from home where possible and brought forward technologies to facilitate online meetings and collaboration based on broadband telecommunications that had steadily been improving. The disbenefits of agglomeration to employees in the form of the time, cost and discomfort of commuting became immediately apparent, with a consequential reluctance to return full time to the workplace. The balance of benefits and disbenefits may have shifted in favour of dispersal, although it may take time to reach a settled outcome.

For employers, increased working from home could lead to a decrease in demand for office space in the centres of cities, although this would depend on how workspace is managed to accommodate staff who are there for only part of the week. Shrinkage of space to save rental costs could make the office a less attractive destination. High quality premises with good facilities within and nearby would be preferred, to attract high quality staff. Older, lower quality buildings are becoming redundant, particularly on account of regulatory requirements to improve the energy efficiency of rented buildings. This presents opportunities to repurpose such redundant workplaces, as has long been the case by creating loft apartments from historic warehouses. The scope for repurposing more recent office accommodation can be limited by the depth of floor plan, since windows would be expected by residents of flats, and by the core location of services. Creation of laboratory space, hotels and student accommodation are being considered. Perhaps the simplest repurposing would be a reversion to residential use of inner city eighteenth and nineteenth century houses built for families with servants but subsequently converted to offices. Such repurposing would fit the concept of the 15-minute city or 20-minute neighbourhood where most needs can be met by active travel within a short distance. However, with many tenants and landlords bound by long term leases, it will take time for the extent of the full changes to occupancy to emerge

While reduced use of public transport for commuting means less crowding at peak times, it also results in less revenue for the operators and so either more subsidy is required, or the outcome is poorer service and/or higher fares. This raise the question of the role of bus and rail travel in sustaining the economic and social vibrancy of towns and cities, particularly those whose density is such the general use of the car is not viable. The scope for raising fares is limited by use made by those who cannot afford a car, which means that some external source of funding support is required. Support from government was increased substantially during the pandemic as an emergency measure, but the longer-term position remains to be seen. Transport for London (TfL) has been more dependent on operating income from passenger revenue than other major cities, hence it was hit harder by the loss of fare income during the pandemic so that tortuous negotiations with central government were required to avoid serious loss of services. The case for increased external subsidy to sustain high quality public transport fits well with the need to decarbonise the transport sector by offering alternatives to car use, given that internal combustion engine vehicles will be dominant for some years to come.

It is possible that the time saved by commuting less will be used for other travel, given the long run invariant hour a day of average travel time. If this other travel is local active travel, cycling or walking, that would be helpful for reducing the environmental impact; if by car, less so, particularly if commuting had been by public transport. Working from home also allows living more remotely from the workplace if travel to work is less frequent; this leads to changes in residential property prices as between urban and rural locations, and new construction where land with planning consent is available for development, with consequential changes for travel behaviour, particularly increased car use.

Online shopping

The other shift prompted by the pandemic was to online retail, growth of which was accentuated markedly. Yet shopping is also a social activity, and the suitability of many goods are best judged first hand, whether the feel and look of fashion items or the bulk of furnishings. Data for internet sales as a proportion of total retail sales had been on a steadily increasing trend before the pandemic, rising from around 3% in 2007 to 19% immediately before the pandemic. It spiked to reach 38% in early 2021 before falling back to 25% in mid-2022, broadly returning to trend, although for how long the upward trend will continue is as yet unclear.

The main impact of this shift to online shopping has been to reduce the attractiveness of city centre department stores, some chains of which have closed entirely while others have shut some branches and repurposed floor space in continuing locations. Stronger city centres that relied on a wide catchment area were most affected by the pandemic, while highstreets in economically weaker cities and towns were less affected, although many were already experiencing difficulty in attracting shoppers and shops on account both of general economic conditions in towns that had lost major industries and the shift to online retail. Over time, rents will adjust to a lower demand for retail floor space, either allowing new entrants or repurposing for other uses.

Implications for travel demand

Department for Transport monitoring data showed that, by April 2022, motor vehicle use nationally had returned to just over 100% of pre-pandemic levels. Public transport use grew back at slower rates and some components have tended to remain below pre-pandemic levels: by late 2023, national rail use was 85% of that observed in the same period in 2019, London Underground use a little higher, and bus use was about 90%, although there have been significant fluctuations due to school holidays, weather events, tourist flows and industrial action. Use of the Underground to central destinations bounced back more quickly at weekends than in the week.

There was a burst of recreational cycling during the first lockdown, reaching a peak of 63% above a 2013 baseline in mid-2021, falling back to a 24% increase above 2013 in late 2022, consistent with a modest rate of long-term growth. Although there were many adaptations to urban roads at the outset of the pandemic to facilitate cycling as an alternative to crowded public transport, the ultimate impact of this will not be clear until the extent of return to the office becomes evident.

The findings for 2022 as a whole, from the National Travel Survey, show only partial return to pre-pandemic levels, which may reflect the emergence of the Omicron variant in late 2021, even though travel restrictions were lifted by February 2022. Thus, average travel time prior to the pandemic was close to 60 minutes a day; during 2020 and 2021 it fell to about 45 minutes, but rose in 2022 to 53 minutes. It would not be surprising if average travel time returned to an hour a day in 2023, although it remains too early to rule out some longer term change in travel behaviour, for instance from increased working from home. Thus, the average number of commuting trips in 2022 was 85% of that in 2019, whereas the average number of education trips (including escorting) was 94% of the earlier year, indicating the greater opportunity for working from home in contrast to studying at home. Average car mileage in 2022 was 89% of that in 2019.

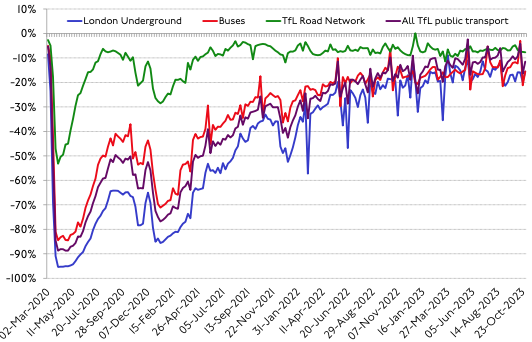

Data published by Transport for London provide a more granular account of the position as of late 2023 (see Figure). Overall public transport demand reached 90% of the pre-pandemic baseline. There has been a consolidation of weekday travel on Tuesdays to Thursdays, where demand is typically higher than on Mondays and Fridays (particularly on rail modes), although only 26 per cent of all London residents have the option to work from home, reflecting a ‘blue collar’ versus ‘white collar’ difference. There is also more travel on weekends than on some weekdays, and slightly longer average journey lengths, all of which appear to be becoming established features of post-pandemic demand.

Conclusions

A key question is whether the travel changes triggered by the pandemic will have long term impacts that will help achieve transport decarbonisation. The evidence is that car use rebounded towards pre-pandemic levels faster than public transport use, where full recovery has yet to occur, and may not do so if working from home persists as an alternative to the full week in the workplace. Active travel at best shows a slow growth trend.

The pandemic has shown that we could make major changes to lifestyle and travel behaviour under the impetus of concerns about personal health. Coming out of the pandemic, some analysts saw indications of a long-term shift to travelling less, notably those working from home making less use of the car. It is possible that working from home will prove to be a long term feature for those for whom it is practicable and where employers are amenable, resulting in more agreeable and less crowded and congested commuting. Yet this leaves open whether and how the saving in commuting time might be used, whether for nontravel activities or for other kinds of journey purpose, and by what mode.

The full impact of the pandemic on travel behaviour therefore remains to be seen, yet the emerging evidence suggests that we largely reverted to pre-pandemic travel behaviour, particularly by car, once the threat to health had receded. The impetus of the climate emergency is less immediately pressing, and so we persist in travel behaviour that meets our needs for access to people, places, activities and services, with the opportunities that ensue, hoping that advances in technology would avoid having to make hard choices about travelling less. Those seeking substantial reductions in car use to mitigate climate change can take but little comfort from the pandemic experience.

This blog was the basis for an article in Local Transport Today 23 January 2024.