The House of Commons Transport Committee is holding an inquiry into major transport infrastructure projects. Written evidence has been published. My evidence is set out below.

This submission is concerned with the effectiveness of the Government’s decision-making and appraisal processes for transport infrastructure projects, a subject on which I have researched and published in peer-reviewed journals.

Main points

- The standard approach to the economic appraisal of transport investments, based largely on the value of time savings, does not reflect reality. An independent review of the methodology would be desirable.

- The value of transport investment lies in better access to people and places, making possible more opportunities and choices. Improved access changes the built environment, the consequences of which can be valued.

- Digital navigation (satnav) is affecting traffic flows, and thus the outcomes of road investment, in ways that are little understood. A study is needed.

Time is not saved

The Department for Transport (DfT) has a well-developed methodology for the appraisal of transport infrastructure investments, set out in considerable detail in its Transport Analysis Guidance (TAG, formerly WebTAG, reflecting the pioneering effort to make the material available via the internet). The Guidance is consistent with the Treasury’s Green Book, and indeed appears to be regarded as an exemplar of good practice in economic appraisal in the public sector. However, the Green Book does not deal with the specifics of transport investment, so that the recent changes to it, while welcome, do not bear on what follows.

The main economic benefit supposed to arise from investment in transport infrastructure is the saving of travel time. Accordingly, the DfT has commissioned considerable analysis designed to attribute values of time to different classes of user of the transport system, according to mode and purpose of travel. Travel time savings typically amount to 80% of overall economic benefits that are set against capital and other costs in the cost-benefit analysis employed to help reach investment decisions.

Average travel time has been measured regularly in the National Travel Survey (NTS) and has barely changed over almost fifty years, at close to an hour a day for travel by all modes except international aviation. So, there is a paradox in that huge past investments in transport infrastructure have been justified by the expected value of travel time saved, which yet is not apparent in any change in travel time averaged across the population.

The explanation is that travel time savings are quite short run. In the long run, people take the benefit of faster travel to travel further, to gain access to more people and places, to have more opportunities and choices. Thus, while average travel time remained constant, the average distance travelled increased from 4500 miles a year in the early 1970s to around 7000 miles in the late 1990s. The economic benefits to users of transport infrastructure investment therefore are not time saved for more work or leisure, but rather relate to enhanced access to, and choice of, jobs, homes, schools, shops and other services.[1]

Such access is subject to diminishing returns. For instance, 80% of urban residents in Britain have access to three or more large supermarkets within 15 min drive, and 60% have access to four or more, a level of choice likely for most to remove the need to travel further for yet more choice[2]. On the other hand, access increases with the square of the speed of travel, since what is accessible is defined by the area of a circle whose radius is proportional to the speed of travel. The combination of access increasing with the square of travel speed yet subject to diminishing returns means that travel demand to achieve access saturates, that is, it ceases to grow.

Such demand saturation, also known as market maturity, is of course a standard feature of consumer markets generally and it is to be expected for daily travel. The finding of the NTS that the average distance travelled has not increased over the past twenty years is consistent with this expectation. So rather than planning for ever more transport infrastructure investment based on time savings, we should limit investment to meeting specific access deficiencies in what is generally a mature transport system. This points, for instance, towards investment in urban rail that can increase economic density and hence agglomeration benefits, as the National Infrastructure Commission has argued[3], rather than on inter-urban roads where the benefits are overstated, as the following case study illustrates.

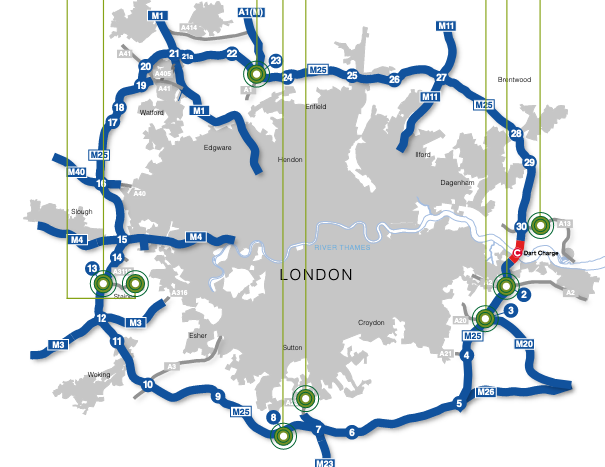

In 2015 the London orbital M25 was widened from three to four lanes in each direction between junctions 23 and 27, part of the so-called ‘Smart Motorway’ programme of Highways England, with detailed monitoring of traffic volumes and speeds before and for the first three years after opening. The growth of traffic was substantially greater than on major roads in the region and greater than forecast in the transport modelling used to justify the investment. The model predicted a significant increase in traffic speed, which generated travel time savings contributing to a benefit-cost ratio (BCR) of 2.9, which represented high value for money. However, beyond the first year, no increase in traffic speed was seen on account of the additional traffic. The evidence suggests that this is due mainly to local users rerouting between unchanged origins and destinations to take advantage of shorter journey times via the motorway, while incurring greater fuel costs. The outturn BCR must be quite small.[4]

This M25 case is likely to be representative of much planned investment in new capacity on the Strategic Road Network, which comes under greatest stress in or near urban centres where local traffic competes for carriageway with the long-distance users for whose benefit the investment is primarily intended. Rerouting to take advantage of new capacity is facilitated by the widespread use digital navigation (satnav) devices that offer routes with the shortest time.

At present, optimism bias in modelling means that traffic growth is underestimated and time savings overestimated. Monitoring of traffic flows before and after opening is too crude a measure to understand the consequences of the investment for the different classes of road user. Accordingly, we need to monitor the changes in travel behaviour of a representative sample of users, employing the travel diary technique as used for the National Travel Survey. This would allow transport models to be better calibrated, such that changes in access could be identified and valued, and externalities (carbon emissions, pollutants etc) that are related to vehicle-miles travelled better estimated. In particular modelling needs to take account of the impact of digital navigation on traffic on the road network.

Built environment is changed

The focus on travel time savings in the standard approach to appraisal means that the impact of transport investment on the built environment is not properly taken into account. Consider a proposal to construct a bypass around a village, motived by concerns about the local environmental impact of traffic. The economic case would be based largely on the value of travel time savings from a faster route. However, a bypass may make land more accessible for development, for instance for housing, subject to decisions of the planners and the prospective return to developers. A bypass scheme with housing is clearly different from one without, as regards both traffic and economic benefit. The standard approach to appraisal disregards the benefit of new housing when estimating the BCR on the grounds that this would double count the user benefits, which might be shifted to others such as land owners but which would not change in overall magnitude. In reality, the impact of the scheme with housing is very different from that without and they need to be appraised separately.

More generally, the real-world outcomes of transport investments depend on decisions by planners and developer. It has been attractive for the DfT to operate in a silo, disregarding changes in land use, initially on grounds of simplicity that were perhaps justified in the heyday of motorway construction. But now that we have a mature network of transport infrastructure in place, with only fairly marginal increases feasible on account of the high cost of civil engineering work, we need to focus on the benefits of new schemes beyond the traditional user benefits. Decision-making needs to be tripartite, involving planners, developers and transport authorities.

The broad objectives of investment in transport infrastructure are threefold: to stimulate economic growth; accommodate population growth; and mitigate environmental harm. Accordingly, we need an approach to appraisal that helps reach investment decisions relevant to these objectives, or whatever more specific versions may be decided by those holding devolved budgets. Changes to the built environment need to be recognised explicitly since they are important to achieving objectives, whether to make sites accessible for new housing or for business expansion. Moreover, changes to the built environment are spatially located, whereas time savings are not, yet location of benefits is very relevant to investment decisions. For instance, the economic case for HS2 was based largely on benefits to users of the new route and was silent on spatial distribution, whereas the strategic objectives were concerned to rebalance the economy in favour of regions beyond London[5].

An innovative approach to decision-making has been developed by the National Infrastructure Commission for its recent assessment of rail needs for the Midlands and the North[6]. This focuses on the way in which improved rail services can increase the effective density of city centres, which has long been recognised as boosting the productivity of businesses from agglomeration benefits through more efficient labour markets, better supply chains and enhanced knowledge sharing. The Commission has extended this analysis to capture the consumption impacts of agglomeration through access to increased amenities, which replaces conventional time saving benefits. Separately, the Commission has developed a property value uplift tool that allows the estimation of the impact of transport investment on property prices[7].

Digital technologies

The widespread use of digital navigation was mentioned above. The other important new technology is the digital platform, used by ride-hailing businesses to match demand to supply, as exemplified by Uber. Much is known about the impact of ride-hailing on traffic in US cities because the authorities are able to require provision of data as a condition of the companies’ operating licence. This has prompted the companies to volunteer data provision to help cities address urban transportation needs.

In contrast to ride-hailing, the providers of digital navigation are secretive. Little is known about the algorithms that calculate routes in the light of prevailing congestion, and how the guidance to users affects traffic flows generally. It is noteworthy that the DfT has recently revised its road traffic statistics to generate an increase of 26% of motor vehicle traffic on minor roads over the past ten years[8]. It is likely that this has been due in large part to use of digital navigation that makes minor roads usable to those without local knowledge.

The lack of appreciation of the impact of digital navigation is remarkable, given its likely influence on the functioning of the road network. The DfT’s Road Investment Strategy 2: 2020-2025 makes no mention of the use of satnav (although there is an illustration of a device on p38). Highways England created a ‘high-tech corridor’ on the A2/M2 in Kent to trial digital communications between roadside infrastructure and vehicles, to improve journey time reliability, yet this appears to pay no regard to the general use of digital navigation. The prospects for investment in such a publicly funded guidance system look poor, given the benefits provided without charge by the private sector providers of digital navigation.

A better approach to taking advantage of digital navigation to improve the operation of the road network would be through regulation. There is in fact legislation in place, but never used, to licence providers of dynamic route guidance. Licence conditions could include the provision of traffic information to road authorities and the avoidance of use of unsuitable roads.[9] Guidance to users is provided without direct charge, hence accommodating such licence conditions should not affect the business models of the providers, which depend either on selling direction-finding to retailers’ websites or mapping services to vehicle manufacturers.

Conclusion

The standard DfT approach to appraisal is no longer suited to decisions on investments in a mature transport system. The standard methodology has become vastly elaborate and misses the point that the benefit of investment is better access, which is seen as changes to the built environment. Decision-making needs to involve planners and developers as well as transport authorities. The National Infrastructure Commission has developed alternative approaches that better reflect the reality. An independent review of appraisal methodology would now be desirable.

Digital navigation seems to be having a significant impact on traffic flows. While the consequences are as yet little understood, it appears likely that the modelled benefits of road investment would be overstated if local traffic rerouting is disregarded. It would be desirable for the DfT to commission a study of the impact of digital navigation on the road network.

January 2021

[1] Metz, D. (2021) Time constraints and travel behaviour. Transportation Planning and Technology,44 (published online).

[2] Competition Commission, The supply of groceries in the UK market investigation, 2008. Fig 3.9

[3] National Infrastructure Commission, National Infrastructure Assessment, 2018.

[4] Metz, D. (2021) Economic benefits of road widening: discrepancy between outturn and forecast. Transportation Research Part A, (forthcoming).

[5] Department for Transport. Full Business Case: High Speed 2 Phase One. 2020.

[6] National Infrastructure Commission. Rail Needs Assessment for the Midlands and the North: Final Report. 2020.

[7] https://nic.org.uk/studies-reports/national-infrastructure-assessment/uplift-tool/

[8] Department for Transport. Benchmarking Minor Road Traffic Flows for Great Britain, 2018 and 2019: Methodology Report. 2020.

[9] Road Traffic (Driver Licensing and Information Systems) Act 1989.